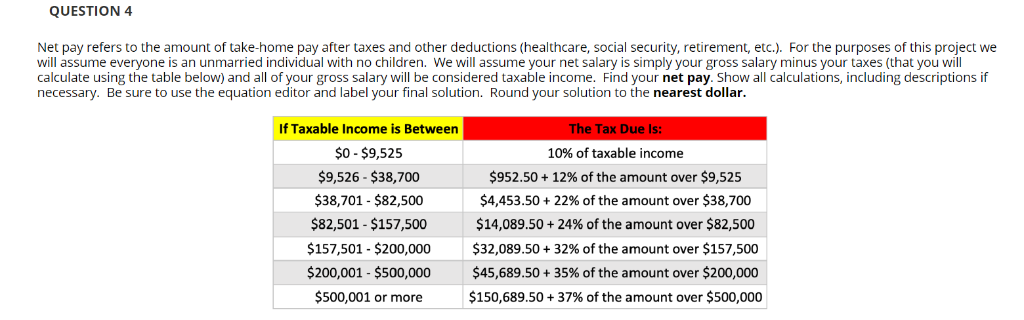

20+ Worksheet #3 Calculating Salary Gross Pay

Publication 3 - Introductory Material Whats New Reminders Introduction. As a business owner you may choose to pay yourself an income or salary.

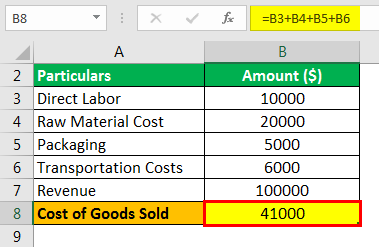

Gross Income Formula Step By Step Calculations

Get all these features for 6577 FREE.

. On the dotted line next to line 20 enter PYAB and the total amount of benefits you received before 2021. An advance of pay may also be authorized for medical emergencies. The annual amount is your gross pay for the whole year.

The limitation shown on the Line 3 Limitation Chart and Worksheet in the Instructions for Form 8889 Health Savings Accounts HSAs. SALARIED_HOURLY_RATE_PERIOD_BASIS divides salary by the number of payroll periods in a year and divides this result by the number of week day working. If you receive tips of 20 or more in a month while working for any one employer you must report to your employer the total amount of tips you receive on the job during the month.

Complete Form 8839 through line 28. Due date of return. File Form 1040 or 1040-SR by April 18 2022.

If your annuity starting date was before this year and you completed this worksheet last year skip line 3 and enter the amount from line 4 of last years worksheet on line 4 below even if the amount of your pension or annuity has changed. To a foreign post or between foreign posts however not between a foreign post and the US. If an amount other than a rollover is contributed to your Archer MSA this.

These instructions will help you complete the Company tax return 2021 NAT 0656 the tax return for all companies including head companies of consolidated and multiple entity consolidated MEC groups. 50 of net pay for needs 30 for wants and 20 for savings and debt repayment. On Form 8839 line 20 enter the total amount of employer-provided adoption benefits received in 2021 and all prior years.

Gross income includes gains but not losses reported on Form 8949 or Schedule D. Calculating gross contribution margin for a bakery This is an example contribution margin gross profit per unit for a bakery that sells sweet rolls savoury. 503 to the Instructions for Form 2441.

Only the portion you pay is taken into account. Per period amount is your gross pay every payday. You will only need to pay for mortgage insurance if you make a down payment of less than 20 of the homes value.

Our online services is trustworthy and it cares about your learning and your degree. These employees are included in the Executive and Administrative Salary EAS pay structure which also covers executives. Enter the appropriate number from Table 1 below.

The mathematical result is that theres a high likelihood you are at the point where working is optional in 15-20 years depending on market conditions of course. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing. 1 the 2021 calendar year population-based component of the State.

We moved Worksheet A Worksheet for 2020 Expenses Paid in 2021 from Pub. Worksheet for 2020 expenses paid in 2021. Any previous impairment to the member under consideration is included in calculating the percentage of loss.

531 Method of Payment for Compensation Last Modified on January 25 2018 Section 7511 of the BOR Policy Manual states that electronic funds transfer is the required method of payroll payments to employeesAll employees are required to be paid by electronic funds transfer by authorizing the direct deposit of funds into their financial institution account within thirty 30. No more than 50 of the gross income of either business was derived from royalties rents dividends interest and annuities and you otherwise meet the requirements listed in Regulations section 1414c-4b5ii. Worksheet 1-4 Tax Computation Worksheets for.

Gross income from a business means for example the amount on Schedule C Form 1040 line 7. The due date is April 18 instead of April 15 because of the Emancipation Day holiday in the District of Columbiaeven if you dont live. Your salary may have been reduced to pay for these benefits.

With course help online you pay for academic writing help and we give you a legal service. We can also offer you a custom pricing if you feel that our pricing doesnt really feel meet your needs. Otherwise go to line 3.

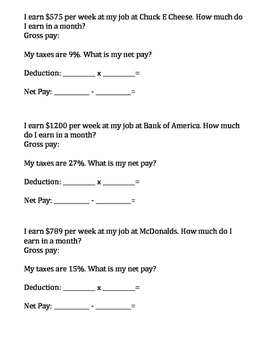

The gross pay method refers to whether the gross pay is an annual amount or a per period amount. The less you pay. Salary reduction contributions to a.

The rules for calculating the credit have also changed. For example if your annual salary were 52000 and you are paid weekly your annual amount is 52000 and your per period amount is 1000. Lets say hypothetically you make a 100000 salary and you pay 15000 in taxes of all.

Enter the amount from line 3 of this worksheet on Form 8839 line 19. Mortgage insurance typically costs 05 185 percent of your loan amount per year billed monthly though it can go higher or lower depending on your credit. In most cases it includes only income from US.

Advance of Pay DSSR 850. Before sharing sensitive information make sure youre on a federal government site. Hence you should be sure of the fact that our online essay help cannot harm your academic life.

Order your essay today and save 20 with the discount code ESSAYHELP. Our 503020 calculator divides your take-home income into suggested spending in three categories. This service is similar to paying a tutor to help improve your skills.

The higher result should be accepted as the pay rate for COP. Gross income includes gains but not losses from asset transactions. Project the taxable income you will have for 2022 and figure the amount of tax you will have to pay on that income.

Depending on modified adjusted gross income you may receive an enhanced credit amount of up to 3600 for a qualifying child under age 6 and. To download a PDF copy of the return or order a paper copy through our publication ordering service go to Company tax return 2021. You can pay the center 150 for any 3 days a week or 250 for 5 days a week.

For this purpose any premium paid through a salary reduction arrangement. The gov means its official. This notice advises State and local housing credit agencies that allocate low-income housing tax credits under 42 of the Internal Revenue Code and States and other issuers of tax-exempt private activity bonds under 141 of the population figures to use in calculating.

Or Schedule F Form 1040 line 9. Federal government websites often end in gov or mil. You can adjust to net income by deducting the taxes you pay from your gross income.

If a or b applies see the instructions for lines 6a and 6b to figure the taxable part of social security benefits you must include in gross income. Use the worksheet indicated to enter estimates for those figures. Your child attends the center 5 days a week.

You may have to pay an additional 20 tax discussed later on your taxable distribution. Gross income from a business means for example the amount on Schedule C line 7 or Schedule F line 9. There is one predefined formula for calculating an hourly rate from a salary SALARIED_HOURLY_RATE_PERIOD_BASIS This formula calculates the ordinary pay hourly rate for salaried employees.

This should be equal to what you would pay an employee to do the same work and include superannuation. Up to three months salary minus certain deductions as designated by the agency may be advanced when an employee is assigned from the US. The percentage of qualifying expenses eligible for the credit has increased along with the income limit at which the credit begins phasing out.

Solved Gross Salary 33 104 Step 1 Find The Net Pay Step Chegg Com

Worksheet 3 Calculating Salary Gross Pay Answer Key 1 Chris Makes 48000 A Year Course Hero

Payroll Formula Step By Step Calculation With Examples

Mathematical Literacy Grade 12

Worksheet 3 Calculating Salary Gross Pay Answer Key 1 Chris Makes 48000 A Year Course Hero

Gross Income Formula Step By Step Calculations

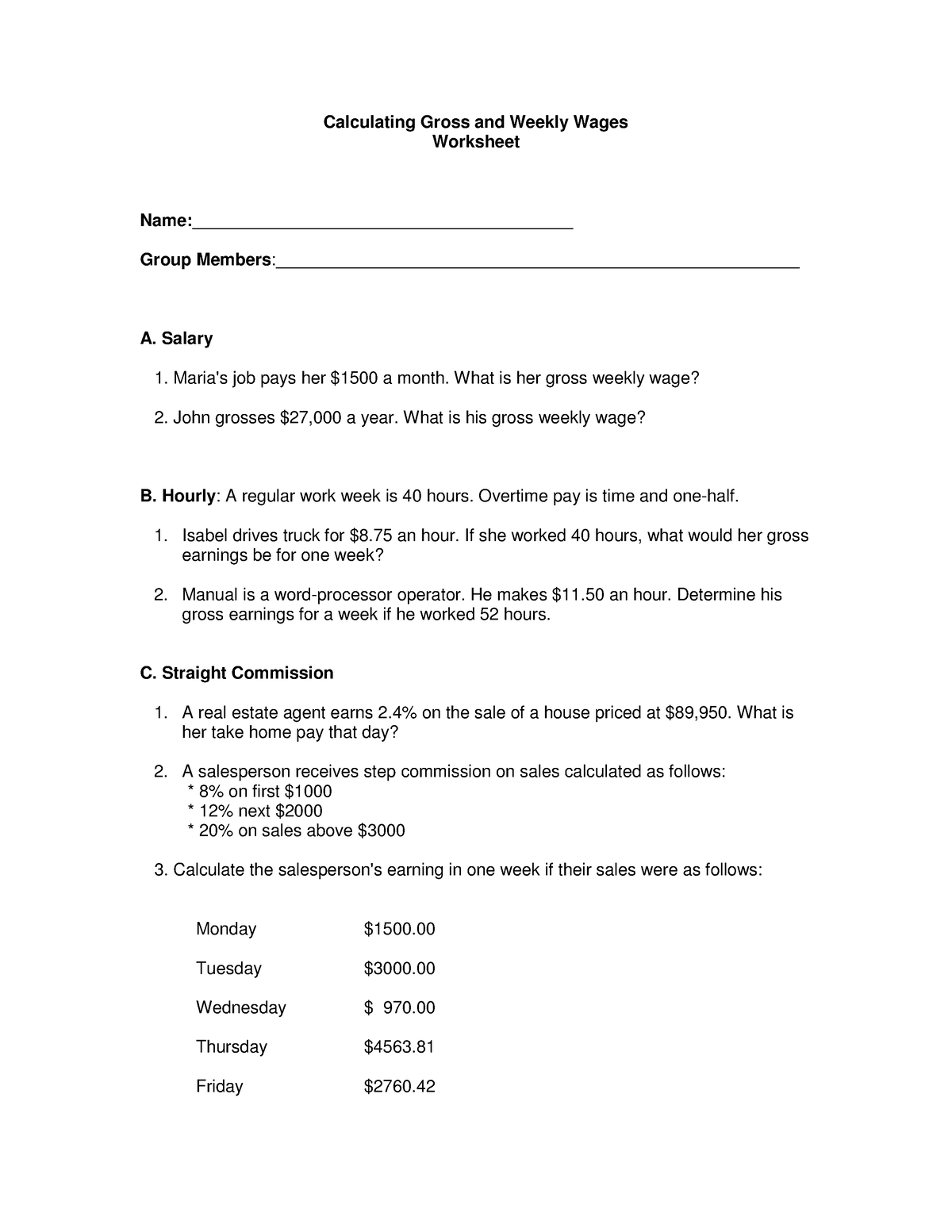

Wages Worksheet Calculating Gross And Weekly Wages Worksheet Name Peter John Hyde Group Members A Salary 1 Maria S Job Pays Her 1500 A Month Course Hero

Net And Gross Pay Workbook 4 Worksheets By Sophie S Stuff Tpt

What Is Dupont Analysis Formula Ratios Calculator

Calculating Gross And Weekly Wages Worksheet Calculating Gross And Weekly Wages Worksheet Name Studocu

Net And Gross Pay Workbook 4 Worksheets By Sophie S Stuff Tpt

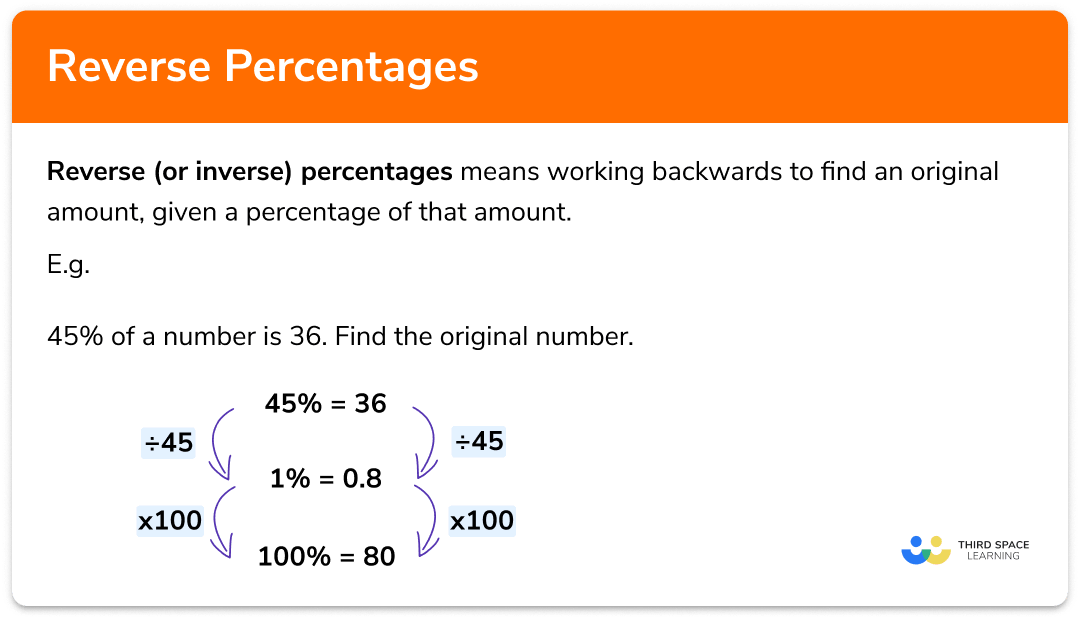

Reverse Percentages Gcse Maths Steps Examples Worksheet

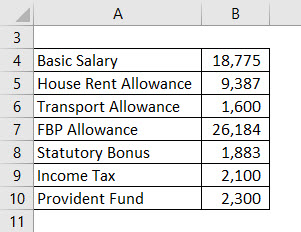

Salary Formula Calculate Salary Calculator Excel Template

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Divorce Finance Worksheet

Income Tax Formula Excel University